When beginner traders view the different forex charts, it could seem intimidating. However, each chart aims to provide traders with convenience, rather than confusion. For traders to identify potential trade opportunities, it’s essential to understand the construction of forex charts and the distinct types of forex charts available to choose from.

What Are Forex Charts?

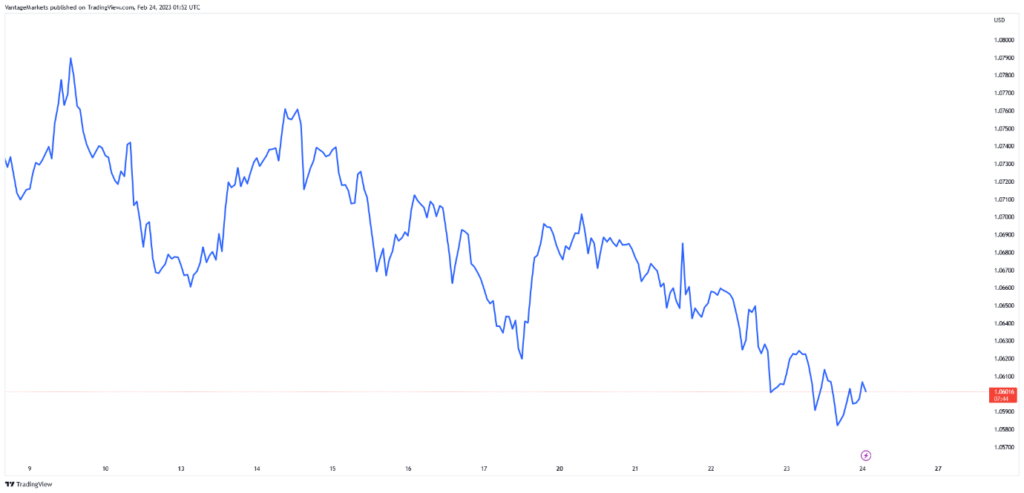

Forex charts are graphical representations of currency exchange rates over time. These charts provide a visual display of how a particular currency pair has been performing, allowing traders to analyse historical price movements, identify trends, and make informed trading decisions.

The charts can be set to visualize the trading activity that takes place during a single trading period, such as 10 minutes, 1 hour, 2 hours, 1 day, 1 week, or 2 weeks. Shorter time frames may provide more granular details about price fluctuations, while longer time frames offer a broader perspective on trends and market behaviour.

The most common forex charts are usually displayed as line charts, bar charts, or candlestick charts. We will explore these charts further in the article.

How to Read Forex Charts

Forex charts can be read by looking at two main parts: the vertical axis and the horizontal axis. The vertical axis of a chart represents the price scale, indicating the currency exchange rate, which tells you how much one currency is worth compared to another. The horizontal axis represents time and shows the timeframe you are looking at, like minutes, hours, days, or weeks.

Traders can identify trends by examining the overall direction of the chart, whether it’s moving up (bullish), down (bearish), or ranging (sideways). If the chart is going up, it’s called a bullish trend, which means the currency pair is gaining value. If the chart is going down, it’s called a bearish trend, which means the currency pair is losing value. Sometimes, the chart may move sideways, which means the prices are not changing much.

Additionally, chart patterns such as support and resistance levels, trendlines, and chart formations like triangles or double tops/bottoms, can provide valuable insights into potential price reversals or continuation patterns. Various technical indicators, such as moving averages, oscillators, or volume indicators, can be applied to charts to further analyse price action and confirm trading signals.

Learn more about basics of technical analysis with our article here.

Types of Forex Charts

There are three types of forex charts that every trader must know which are line charts, bar charts, and candlestick charts.

1. Line Charts

Line charts are one of the most basic and simple price representations which connects the closing price of an instrument with a continuous line. The simplicity of the line chart allows for the elimination of ‘market noise’, which makes trading the trend much easier [1].

The line chart is especially useful for beginner traders as it teaches the basic skills of chart reading before advancing into other chart types such as bar or candlestick chart. Even technical indicators such as moving averages are presented using a line chart.

2. Bar Charts

Compared to the line chart, the bar chart provides more information regarding the markets. Each bar consists of four key components: open, close, high, and low. The open and close represents the opening and closing price of a specific time frame, while the high and low represents the highest and lowest price the instrument went in a specific timeframe.

The additional detail provided by a bar chart allows traders to conduct more detailed technical analysis. For example, details such as the highs and lows of an individual bar allows traders to determine the range the financial instrument is trading in.

3. Candlestick Charts

Candlestick charts are like bar charts, with the anatomy of a candlestick consisting of an open, close, high, and low. The thicker bodies and colour coding of candlesticks makes it much popular compared to the bar chart, which are generally better at showcasing the open and close of an instrument [2].

The area between the open and close is known as the candle body, while the high and low of the candlestick is called the candle wick. Another notable characteristic is the colour of the candlestick, intuitively, green equates to a bullish candlestick while bearish candlestick is in red (orange).

Traders often use candlestick charts to conduct technical analysis such as candlestick patterns. A singular candlestick provides a wealth of information, and a group of candlesticks form critical patterns that traders use to make market decisions.

Final Thoughts

Understanding how the price of a currency pair changes over time through different graphical representation is a critical skill for traders to interpret raw price action and identify potential trading opportunities. All three types of chart each carry varying characteristics, while it depends on personal preference, traders can always pick the chart that best suits their specific trading strategies.

Looking to view the financial markets through the different chart types? Open a demo account here.

The above images are used for illustrational purposes only.

References

- Axiory Global Ltd. (n.d.). What are the Forex charts? – Different chart types explained. https://www.axiory.com/trading-resources/trading-terms/what-are-forex-charts. Accessed 29 Jan 2024.

- Understanding a Candlestick Chart. (2022, April 8). Investopedia. https://www.investopedia.com/trading/candlestick-charting-what-is-it/. Accessed 29 Jan 2024.