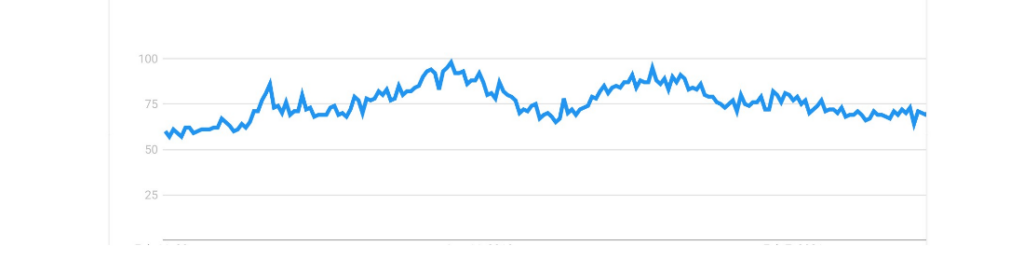

Forex trading has been around since the 1970s but with the advancement of technology, and the advent of online trading platforms across the years, its popularity has been growing exponentially. This can be evidenced by the topic of Forex peaking in popularity globally every year according to Google Trends [1].

As interest in Forex trading continues to grow, this article will serve as an introductory guide for new aspiring traders.

What is Forex?

So, let’s begin with a simple question, what is Forex?

Forex (FX) is short form for foreign exchange which represents the global currency markets. There is an array of entities that participate within the FX markets, and they include central banks, financial institutions, hedge funds, and individual investors or traders [2].

Hence, Forex trading refers to market participants buying or selling different currencies mostly to seek monetary gain. Through the fluctuations in exchange rates, market participants will speculate if one currency will increase or decrease in value compared to another.

Even though there are more than 160 official currencies globally [3], only 4 are widely traded. These currencies are:

- US Dollar (USD)

- Great British Pound (GBP)

- Japanese Yen (JPY)

- Euro (EUR)

What is Forex market?

Now that we have a basic understanding of Forex, let’s delve deeper into the Forex market itself. The Forex market refers to the decentralised global marketplace where currencies are bought and sold. It operates 24 hours a day, five days a week, allowing participants to engage in currency trading from different parts of the world. There are a few different types of markets where Forex can be traded, primarily via spot, forwards, and futures markets [4].

Unlike traditional stock markets that have a centralised exchange, the Forex market operates through an interbank market. This means that transactions are conducted directly between participants, such as banks, financial institutions, and individual traders, without a physical location or exchange floor.

Why Trade Forex?

As the largest financial market in the world in terms of trading volume, liquidity, and value, the FX market provides countless of trading opportunities for traders to take advantage of.

Through the years, the total value of the FX market has been increasing with no signs of stopping. As of 2022, the average daily trade volume is USD$6.6 trillion. The increasing liquidity equates to quicker and easier transactions with low spreads for traders [5].

The trading hours of the FX markets is another good reason to be trading Forex. Open for 24 hours throughout all 5 weekdays, this gives traders the convenience to select a timing suitable for them. The ability to both buy and sell also allows for increased trading opportunities under various market conditions. Not only can traders take advantage on the rising currency prices, we can also make a winning trade by selling when one currency depreciates against another [6].

Last but not least, you can employ leverage when trading forex in order to make larger trades with a smaller amount of capital. When used properly, coupled with adequate risk-management tools, leverage can potentially magnify your returns. However, you should keep in mind that leverage works as a double-edged sword, which could also lead to great losses [7].

Interested in trading with the best conditions a broker can offer? Vantage offers forex spreads as low as 0.0, with $0 deposit fees, and a leverage of up to 500:1. Sign up with a demo account here.

How forex trading works?

Understanding how forex trading works is similar to the process of exchanging currency while traveling abroad. Just like in those situations, forex trading involves the buying of one currency and the selling of another. The exchange rate between the currencies fluctuates in response to the forces of supply and demand. In forex trading, traders participate in transactions that involve different currency pairs, allowing them to potentially earn from the changes in these exchange rates.

Currency pairs

When engaging in forex trading, traders always deal with currency pairs. Each pair consists of a base currency and a quote currency. The base currency is the first currency in the pair, while the quote currency is the second. Together, they form a unique trading instrument that reflects the exchange rate between the two currencies.

Some of the commonly traded currency pairs include EUR/USD (Euro/US Dollar), GBP/USD (Great British Pound/US Dollar), USD/JPY (US Dollar/Japanese Yen), and USD/CHF (US Dollar/Swiss Franc). These pairs dominate the forex market, boasting high liquidity and active trading volumes [8].

How to start trading forex

Here are a few steps to help you get started with your forex trading journey:

1. Start by opening an account with a well-established broker such as Vantage.

2. Begin researching the currency pairs that you want to trade. Read market news to familiarise yourself with the factors that influence currency movements.

3. Open a position for currency pairs. Go long and “buy” if you believe the currency pair will strengthen, or go short and “sell” if you think it will weaken.

4. Monitor your trade and close your position when you think the time is right.

Forex trading strategies

Forex trading strategies are used by traders to provide structure to their trading efforts and defines how they will enter and exit trades. There are a variety of methods used by traders to identify the entry and exit points. Here are a few examples of forex trading strategies traders can use in their future trades:

Swing Trading [9,10]

Swing trading is an approach focused on identifying upcoming changes in a trend and executing trades prior to these changes to capitalise on resulting profits. This strategy is typically implemented over a medium-term timeframe, ranging from a couple of days to several weeks, depending on the duration of the trend.

Implementation of this forex trading strategy requires traders to be comfortable holding positions for an extended period as prematurely closing trades can result in missed opportunities for future gains. It is important to note that swing trading can be challenging due to the need to navigate short-term market volatility, and it requires a larger capital base to absorb price fluctuations that may occur during the trend.

Day Trading [11,12]

Day trading refers to the practice in which a forex trader executes trades within a single day, opening and closing positions without holding them overnight. This approach is employed for various reasons. Firstly, day trading takes advantage of the inherent volatility of the forex market, enabling traders to potentially capitalise on sudden price movements occurring throughout the day.

Additionally, it helps mitigate risks associated with substantial market fluctuations on a larger scale or overnight price gaps that may arise when the markets are closed, depriving traders of the ability to react. Successful day trading requires a comprehensive understanding of the market and global events, the discipline to adhere to a predetermined trading routine, and the ability to adapt promptly to changes.

Range Trading [13,14]

Range trading is a strategic approach in which multiple trades are executed while a currency pair exhibits a horizontal movement, oscillating between the support and resistance levels for an extended duration. When the market remains in a consolidation phase, characterised by a sideways motion, it is referred to as a range-bound market in the context of range trading within the forex trading community.

This method entails employing both long and short positions, wherein traders purchase when the price descends towards the support level and sell when it ascends towards the resistance level.

Learn more about all the top forex trading strategies here.

Forex trading terminology

When trading forex, there are a few technical forex jargons that one must know before they start trading. Here are some trading jargons that all traders should know to trade with confidence:

Margin

Margin is the money you need to deposit with your broker when you want to start trading. It’s like a deposit that shows you can cover any potential losses.

Pip

Pip stands for “point in percentage”, which is a currency pair’s smallest unit of price movement. It helps determine if a trade has made a profit or loss. For most currency pairs, a pip is the fourth decimal place, except for the Japanese yen, where it’s the second decimal place (e.g., USD/JPY = 86.51).

Lot

A lot is a standard measure of the amount of a financial instrument you can trade. The size of a lot depends on the specific market and asset. Buying or selling a lot means trading a specific number of units of the asset.

Spread

Spread is the difference between the highest price a buyer is willing to pay (bid price) and the lowest price a seller is willing to accept (ask price) for a security or asset.

Leverage

Leverage is using borrowed money to increase the size of your trade. It allows traders to control a larger amount with a smaller amount of their own funds. While leverage can increase potential profits, it also increases potential losses.

Base currency /Quote currency

The base currency is the first currency in a currency pair. It’s the currency being compared to the value of the second currency, known as the quote currency. For example, in a USD/JPY currency pair, USD is the base currency, and JPY is the quote currency. This tells you how much JPY is needed to buy one USD.

Interested to learn more about all these terms? Read our top 30 forex terms all traders should know article here!

When Can You Trade Forex?

The FX markets are available 24 hours a day, open 5 days of the week. Each day is dissected into four major sessions; Sydney, Tokyo, London, and New York. Table 1 below goes into the specific opening and closing timings for each respective session.

| Session | Timing (UTC / GMT +0) |

| Sydney | 0800 to 1700 |

| Tokyo | 1200 to 2100 |

| London | 2000 to 0500 |

| New York | 0100 to 1000 |

Traders would usually correlate the session timings to the currency pairs they trade. For example, if one were to trade the pair USDJPY, the Tokyo or New York session would fit perfectly.

Conclusion

As an individual trader, it may seem daunting going against other market participants such as huge institutions but fret not. The opportunities available within the FX market will never run short and through constant practise and discipline, traders can potentially excel under different market conditions.

Now that you have learned about the basics of Forex trading, let’s dive into the types of Forex markets available next.

References

- “Forex – Google Trends” https://trends.google.com/trends/explore?q=forex Accessed 26 June 2023

- “Forex Market: Who Trades Currencies and Why – Investopedia” https://www.investopedia.com/articles/forex/11/who-trades-forex-and-why.asp Accessed 26 June 2023

- “List of all currencies worldwide – WorldData.info” https://www.worlddata.info/currencies/ Accessed 26 June 2023

- “What Is Forex Trading? A Beginner’s Guide – Investopedia” https://www.investopedia.com/articles/forex/11/why-trade-forex.asp Accessed 26 June 2023

- “Forex Trading Statistics – Compare Forex Brokers” https://www.compareforexbrokers.com/forex-trading/statistics/ Accessed 26 June 2023

- “Why trade forex – Forex.com” https://www.forex.com/en/education/education-themes/trading-concepts/why-trade-forex/ Accessed 26 June 2023

- “Why is Forex Popular – My Trading Skills” https://mytradingskills.com/forex-for-beginners/why-do-people-trade-forex Accessed 26 June 2023

- “Major Pairs: Definition in Forex Trading and How to Trade – Investopedia” https://www.investopedia.com/terms/forex/m/majors.asp Accessed 26 June 2023

- “What Is Swing Trading? – Investopedia” https://www.investopedia.com/terms/s/swingtrading.asp Accessed 26 June 2023

- “Swing Trading: What It Is & How It Works – Seeking Alpha” https://seekingalpha.com/article/4452707-swing-trading Accessed 26 June 2023

- “Day Trading: The Basics and How to Get Started – Investopedia” https://www.investopedia.com/articles/trading/05/011705.asp#toc-day-trading-strategies Accessed 26 June 2023

- “10 Day Trading Tips for Beginners – Investopedia” https://www.investopedia.com/articles/trading/06/daytradingretail.asp Accessed 26 June 2023

- “What Is Range-Bound Trading? Definition and How Strategy Works – Investopedia” https://www.investopedia.com/terms/r/rangeboundtrading.asp Accessed 26 June 2023

- “What is a Range-Bound Market? – BabyPips” https://www.babypips.com/learn/forex/what-is-a-ranging-market Accessed 26 June 2023

- “Forex Market Hours – Babypips” https://www.babypips.com/tools/forex-market-hours Accessed 26 June 2023