The 2022 Soccer World Cup in Qatar has just kicked off and is guaranteed to be the sole focus of attention for millions of people around the world for its four-week duration.

Although this is a sporting event that would on the surface appear to be completely unlinked to financial markets, there are several studies that suggest that the results of World Cup matches can influence price action and provide investors with opportunities to profit. Moreover, there are several brands and companies that are taking advantage of the viewership the event will get by partnering with FIFA as major sponsors, enabling them to create a strong branding presence across the tournament’s physical and digital assets.

This article will look at impact of previous world cups on financial markets, major sponsors to keep an eye on and what both winning and losing can mean for an individual country’s stock market.

Key Points

- Research indicates that the stock market in a country often underperforms after its national team is eliminated from the FIFA World Cup, reflecting investor sentiment affected by the team’s loss.

- Major FIFA World Cup sponsors such as Adidas and Coca-Cola are companies to watch, as enhanced brand visibility during the tournament may influence their stock prices.

- While Adidas’ share price shows signs of a potential uptrend during the World Cup, Coca-Cola faces a more uncertain technical outlook, and McDonald’s exhibits a bullish chart pattern, suggesting possible gains.

World Cup Result Impacts on Stock Markets

One of the major findings from a body of research conducted two decades ago shows that a country’s stock market may underperform following the national team’s ejection from the World Cup. The research study titled “Sports Sentiment and Stock Returns” analysed over 1,000 different matches going back to 1973 and found that, on average after a given country’s football team lost in the World Cup, its stock market produced a significantly below average return the very next trading day. This is hardly surprising given how dejected and disheartened a country’s investors would be following such a disappointing result.

A prime example is the performance of the French CAC 40 Index following France’s penalty shootout loss to Italy in the 2006 World Cup Final. The index fell just shy of 5% in the week after the result as the nation mourned its heartbreaking defeat.

CAC 40 Plunges after France Loses 2006 World Cup Final

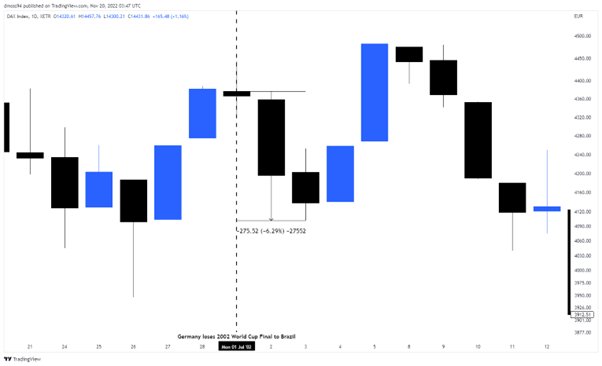

The German DAX index also suffered following the national team’s defeat in the 2002 World Cup Final against Brazil in Japan. The national benchmark index declined 6.3% in just three days after Germany lost 2-0 to an all-time great team in Brazil in Yokohama, Japan.

DAX 30 Slides Lower after Germany Loses to Brazil in 2002 World Cup Final

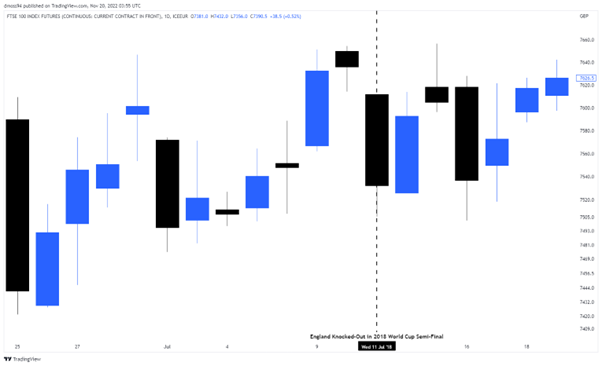

Underperformance of national stock markets are not just isolated to losses in World Cup Finals, however, as can be seen with the FTSE 100’s slide following England’s semi-final loss to Croatia at the 2018 World Cup in Russia. This is an interesting relationship to keep an eye on throughout the tournament in Qatar, especially if there are any shock knockouts in the group stages and latter parts of the competition. A disappointing result by any of the strong European countries could see their national stock index sell-off dramatically in the days after.

FTSE 100 Plunges Following England’s World Cup 2018 Semi-Final Defeat to Croatia

Major Sponsors to Keep an Eye On

There are several major sponsors that traders should keep on their watchlists throughout the Qatar 2022 World Cup, should the prominent display of the company’s branding provide a tailwind for its stock price.

1. Adidas (XETR: ADS)

The German sport and footwear behemoth has been a major partner of FIFA and provided the Official Match Ball for the World Cup since 1970. The firm also provides uniforms for all FIFA officials, referees, volunteers, and ball boys providing them the ability to be font and centre throughout the competition. Adidas’ share price has trended considerably lower since peaking at a record high of €336.26 in August of 2021. However, the share price has stormed higher since the start of this month and looks poised to continue climbing as a Bull Flag forms just below resistance at €138.50. A break above could precipitate a new bull trend and bring the August highs into focus.

2. Coca-Cola (NYSE: KO)

Coca-Cola has also held a long-term sponsorship agreement with FIFA, becoming an official sponsor of the World Cup in 1978. Since 2006, the company has also been a major sponsor of the world ranking for both the men’s and women’s national teams and releases both physical and digital stickers for FIFA World Cup tournaments.

Given that Qatar has strict rules regarding consumption of alcohol, Coca-Cola may enhance its reputation as a beverage catering for everyone and could receive a nice bump in short-term revenues. Technically, the picture is slightly bleaker as price forms what can only be described as a lower high of a bearish downtrend. A break below $60 would probably intensify selling pressure and precipitate a decline back towards the yearly lows set in October.

3. McDonalds

The fast-food giant has sponsored the FIFA World Cup for twenty years and has its branding prominently featured on the uniforms of the child mascots who walk out with the players prior to kickoff. The firm was also the primary sponsor of the tournament’s fantasy football game in 2018.

Out of the three sponsors listed, McDonald’s price chart appears to be the most bullish as price consolidates above its prior record high carved out December of 2021. Remaining positively positioned above prior resistance-turned-support at the August high ($268) could see MCD surge to fresh record-highs in the weeks ahead.

Trade as You Watch the World Cup with Vantage

Take advantage of the opportunities that may present themselves in financial markets during the Qatar 2022 World Cup with Vantage! You can trade the largest stock market indexes in the world with low spreads and rapid-fast trade execution. Vantage also provides traders with the ability to capitalise on the moves of some of the biggest companies in the world with its share CFD offering. To learn more about Vantage and how you can open your very own trading account, click here!